Howard Marks is the Co-Founder and the Co-Chairman of Oaktree Capital management.

This man knows the market.

1/ Howard Marks is the Co-Founder and the Co-Chairman of Oaktree Capital management. He is managing more than $200 billion and has a robust understanding of the market, he wrote a book called "Mastering The Market Cycle" in 2018. In 2021, he called the bubble before anyone

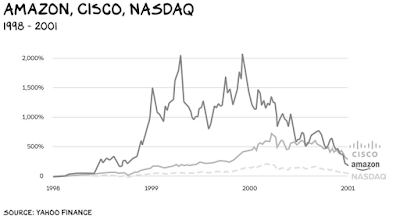

2/ He recently published a new paper: "On Bubble Watch" and made ominous forecasts... He starts with a definition of a bubble: "Bubble is more of a state of mind than a quantitative calculation." He says it was euphoria around a dozen stocks that led to the dot-com bubble.

This happens when investors believe a business is so disruptive that it'll completely dominate the future.

He gives Cisco as an example.

It went up 20x and declined 88% later.

4/ More on the market psychology

Marks flags four words as the second most accurate indicator of euphoria: "It's different this time." He had articulated many times before why this is a very dangerous state of mind:

-------------------------------------------------------------------------------------------------

He says:

- People care about price, but they are willing to pay up.

- There is no general "this time is different" mania.

Yet, he says there are warning signs appearing...

-------------------------------------------------------------------------------------------------

This is dangerous because it assumes prolonged persistence of leading stocks.

He reminds us that of 20 most overweighted stocks of 2000, only 6 of them are still among the top 20 today.

------------------------------------------------------------------------------------------------

7/ He thinks the US market has become too overvalued and overweighted compared to the world markets.The US market now makes up 70% of the world index and magnificent 7 stocks make up 39% of the US market.

Marks says this is unsustainable and it'll have two potential outcomes:

- Severe market correction.

- Prolonged periods of very low returns.

If the overvaluation persists, he says, we will get 3-4% annual returns in the next 10 years.

- Looking at forward valuation ratios.

- Rising concentration in the US market.

- Record share of the US market in the world.

He says this will either take us to a bubble or a long period of very low returns.

-------------------------------------------------------------------------------------------------

Well, there is no definitive prescription, only some suggestions:

- Avoid popular sectors.

- Don't overpay for growth.

- Overweight defensive businesses.

- Diversify into different asset classes.

You can't time the crash but you can prepare.