The Power Couple's Road to Real Estate Riches!

Share Market Training for beginners,Technical Analysis on Equity,Commodity,Forex Market,Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives - Contact - 9094047040/9841986753/ 044-24333577, www.rupeedesk.in) நிதி மற்றும் முதலீட்டு தொடர்பான கல்வி அறிவு சேகரிப்புகள். Rupeedesk Shares - Financial and Investment Related Knowledge collections.

The Power Couple's Road to Real Estate Riches!

K Karthik Raja's Profile - Rupeedesk Consultancy

K Karthik Raja's Profile - Rupeedesk Consultancy

Unlocking Financial Growth: The Strategic Vision of K Karthik Raja

Innovative Wealth-Building Concepts

🚀 Super Assets: Smart Strategies for Multiplying Wealth – A Proven Approach by K Karthik Raja

💰 Super Wealth Stocks: Capturing Market Momentum for Exponential Growth

Professional Profile: K Karthik Raja - Rupeedesk Consultancy

Meet K Karthik Raja – Founder, Rupeedesk Consultancy

K Karthik Raja is a highly respected financial expert with a distinguished career spanning 19 years. As a former SEBI-registered Research Analyst, he has played a pivotal role in shaping investment strategies and market education in India. Currently, he is advancing his expertise by pursuing a Portfolio Management Services (PMS) License from SEBI India.

With a robust educational background—including MCA, MBA, M.Com, MSc Psychology, PGJMC, CST, and MDAT, along with an ongoing CFA certification—Mr. Raja blends financial acumen with psychological insights to offer a holistic approach to wealth creation and investment strategies.

Beyond market analysis, he is a dedicated financial educator, conducting seminars, webinars, and authoring books to empower young investors, women, and professionals with essential financial literacy skills.

Professional Credentials & Certifications

✔ NISM-Series-VIII: Equity Derivatives – National Institute of Securities Markets

✔ NISM-Series-XV: Research Analyst – National Institute of Securities Markets

✔ NISM SEBI Investor Certification – Enhancing investor proficiency

✔ MSME Workshop on EXIM & USDINR Currency Dynamics

Career Milestones

🔹 Research Head at Integrated Enterprises India Ltd. – Led market research initiatives in Chennai.

🔹 Founder of Rupeedesk Consultancy (2012) – Transforming financial consulting and education.

🔹 Financial Market Trainer – Conducting workshops to enhance public understanding of investments.

Areas of Expertise

✅ Wealth Creation Strategies

✅ Stock Market Investments

✅ Technical & Fundamental Analysis

✅ Risk & Money Management

✅ Market Psychology & Behavioral Finance

Notable Achievements

🌟 Market Research & Forecasting Excellence – Recognized for precise market predictions that influence investment decisions across various sectors.

🌟 Media Presence – A regular contributor to financial TV segments, educating a broad audience on investment strategies.

🌟 Published Financial Educator – Authored numerous articles in English and Tamil, promoting financial literacy.

Thought Leadership & Educational Contributions

🎤 Expert Speaker – Featured in leading investment seminars and conferences.

📊 Seminars & Webinars Across Key Sectors:

- Educational Institutions – Instilling financial knowledge in young minds.

- Stock Brokers & Professionals – Providing strategic investment insights.

- Bombay Stock Exchange (BSE) Initiatives – Sharing expertise on market trends.

- Investment Awareness Campaigns – Collaborated with the BSE Investor Protection Fund to educate the public on smart investing.

Educational Impact & Future Projects

K Karthik Raja is committed to financial education and empowerment, particularly for youth and women. His upcoming books focus on:

📖 Stock Market Investing for Beginners

📖 Smart Money Strategies

📖 Understanding Market Risks & Investment Growth

With a mission to simplify financial concepts and make wealth-building accessible to all, his work continues to inspire and educate the next generation of investors.

Super Assets: Multiply Money the Smart Way – K Karthik Raja’s Strategy

Super Assets: Multiply Money the Smart Way – K Karthik Raja’s Strategy

Author

K Karthik Raja (Market Educator & Technical Analyst)

MCA | MBA | M.Com | MSc Psychology | PGJMC | CST | MDAT | CFA Pursuant

Have you ever wondered how some assets not only grow in value but also generate continuous income? These are what I call Super Assets—investments that appreciate over time while creating sustained financial returns.

Understanding Super Assets

Not all assets are created equal. Some depreciate, while others hold value. However, Super Assets are unique because:

✅ They grow consistently over the long term.

✅ They generate passive income year after year.

✅ They never lose their core value, ensuring financial security.

Example 1: The Coconut Tree Strategy 🌴

Imagine you own 100 acres of land and plant a single coconut tree:

- In 4 years, it starts producing coconuts regularly.

- If you reinvest each coconut to grow more trees, your plantation multiplies exponentially.

- By Year 12, your land is filled with trees, producing recurring wealth.

- The system is self-sustaining, making it the perfect Super Asset.

Example 2: The Beehive Model 🐝

Picture starting with just one beehive in your backyard:

- In the first year, it produces a small amount of honey.

- As the bee colony grows, honey production increases rapidly.

- If you reinvest profits into more hives, your honey farm expands exponentially.

- Soon, you have a passive income source—a true Super Asset!

Examples of Super Assets

Want to build long-term wealth? Invest in Super Assets like:

✅ Stocks – Generate long-term wealth with dividends.

✅ Real Estate – Appreciates in value and provides rental income.

✅ Gold & Silver – Stores value and protects against inflation.

✅ Businesses – Scalable ventures that generate sustainable income.

Why Super Assets Matter

Investing in Super Assets ensures that your wealth not only grows but also works for you. Whether it’s stocks, real estate, or businesses, the key is multiplication and sustainability.

Start building your Super Assets today and take charge of your financial future!

Howard Marks' latest warning: 02.03.2025

Howard Marks is the Co-Founder and the Co-Chairman of Oaktree Capital management.

This man knows the market.

1/ Howard Marks is the Co-Founder and the Co-Chairman of Oaktree Capital management. He is managing more than $200 billion and has a robust understanding of the market, he wrote a book called "Mastering The Market Cycle" in 2018. In 2021, he called the bubble before anyone

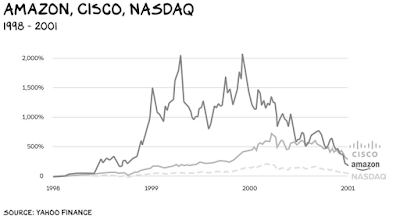

2/ He recently published a new paper: "On Bubble Watch" and made ominous forecasts... He starts with a definition of a bubble: "Bubble is more of a state of mind than a quantitative calculation." He says it was euphoria around a dozen stocks that led to the dot-com bubble.

This happens when investors believe a business is so disruptive that it'll completely dominate the future.

He gives Cisco as an example.

It went up 20x and declined 88% later.

4/ More on the market psychology

Marks flags four words as the second most accurate indicator of euphoria: "It's different this time." He had articulated many times before why this is a very dangerous state of mind:

He says:

- People care about price, but they are willing to pay up.

- There is no general "this time is different" mania.

This is dangerous because it assumes prolonged persistence of leading stocks.

The US market now makes up 70% of the world index and magnificent 7 stocks make up 39% of the US market.

- Severe market correction.

- Prolonged periods of very low returns.

- Looking at forward valuation ratios.

- Rising concentration in the US market.

- Record share of the US market in the world.

Well, there is no definitive prescription, only some suggestions:

- Avoid popular sectors.

- Don't overpay for growth.

- Overweight defensive businesses.

- Diversify into different asset classes.